If cryptocurrency is disrupting finance, then powerful computer chips known as ASICs are disrupting cryptocurrency. Their mere existence turned securing the Bitcoin blockchain, which in the network’s early days could be done at home by average users, into a massive industry that eats up unholy amounts of electricity and generates ridiculous profits for hardware manufacturers.Now, these specialized chips, called application specific integrated circuits (ASICs), are coming for other blockchains. On March 15, the multibillion dollar Chinese company Bitmain tweeted that it was accepting orders for the Antminer X3, a $12,000 ASIC that would be good for only one thing: Mining Monero and other digital currencies secured with the same algorithm. Only two weeks later, on April 3, Bitmain announced the E3, an $800 chip made specifically for mining Ethereum. ASICs like the E3 and X3 are controversial in the cryptocurrency community. Although they are both more efficient at mining compared to graphics cards and CPUs, they are also far more expensive, in short supply, and arguably a driving force behind the centralization of computing power (and the financial rewards from mining) on cryptocurrency networks.

Advertisement

Given how this changed the landscape of Bitcoin mining—leading to the rise of giants like Bitmain in China and BitFury in the US—Monero and Ethereum were designed to be “ASIC-resistant.”Now, the release of the X3 and E3 ASIC miners has sparked an ongoing debate within the cryptosphere about how to address what many see as an existential threat to the integrity of the Monero and Ethereum networks."I will do everything in my power to help the community prevent the proliferation of centralization-inducing ASICs on the Monero network," Riccardo Spagni, a lead Monero developer, wrote on GitHub in February in response to rumors about a possible Monero ASIC.On April 6, Monero tweaked its mining algorithm “to curb any potential threat of ASICs and preserve ASIC resistance.” That same day, Ethereum core developers met to discuss whether they should change Ethereum’s algorithm and ultimately decided not to for the time being, much to the chagrin of the Ethereum community.Like Spagni, many developers fear that ASICs will lead to the centralization of their cryptocurrencies and undermine their biggest selling point: security. If ASICs make mining inaccessible to most people while concentrating computing power in the hands of a few large mining operations, this arguably makes networks more vulnerable to manipulation or censorship by governments or the companies that own the most ASICs.At the same time, other developers in the cryptocurrency world say that the fears of centralization are overblown and that ASICs actually improve the security of a cryptocurrency network by making them harder to dominate with raw computing power.

Advertisement

Clearly, Bitmain overcame both the technical and economic challenges that made Ethereum and Monero ASIC resistant. The question for Monero and Ethereum developers, then, is what are the consequences of introducing ASICs to a cryptocurrency network and what, if anything, should be done about it? Here’s everything you need to know to get up to speed on the good, the bad, and the ugly when it comes to ASIC mining.ASICs have been around for decades and can be found in many common appliances such as your cell phone, but their adoption as cryptocurrency miners only happened within the last few years.The first Bitcoin ASICs were sold in 2013, and since then ASIC miners have been developed for a number of other coins, such as Litecoin and Dash.A straight comparison between CPUs, GPUs and ASICs is difficult since CPUs and GPUs can technically be considered a type of ASIC. The main difference between mining ASICs and CPUs and GPUs is that the mining ASICs don’t have all the extra ‘bloat’ that make CPUs and GPUs so versatile. You can’t run an operating system or play a video game on an Bitcoin ASIC because the chip is meant to do only one thing—mine Bitcoin. So a mining ASIC’s efficiency is gained because all of its computing resources can be optimized for a single well-defined task.Mining is the colloquial term for a resource-intensive computing process that basically involves guessing a number that results in a desired solution when plugged into a hashing algorithm. This value “solves” a block of Bitcoin transaction data, and the block is added to the blockchain. A miner receives a reward in cryptocurrency for this work, and these hash-based algorithms are called proof-of-work (PoW) algorithms.

WHAT IS AN ASIC?

Advertisement

Most major cryptocurrencies use a unique PoW algorithm. For example, Bitcoin uses a hashing algorithm called SHA-256, Monero uses CryptoNight, and Ethereum’s PoW algorithm is called Ethash. There are many different reasons to choose one PoW algorithm over another, but as far as ASICs are concerned, it mostly comes down to memory requirements. Unlike Bitcoin, Litecoin, or their countless derivatives that have been overtaken by ASICs, Ethereum and Monero are considered “memory hard,” meaning they require a decent amount of RAM to run their hashing algorithms.

Two Antminer S9 ASICs. Image: Daniel Oberhaus/Motherboard

CPUs and graphics cards are chips that can be used for a wide range of different tasks. What these types of chips lack in raw efficiency, they make up for in their ability to run processes that require a lot of data to be stored in a computer’s memory. RAM slows down ASICs, so algorithms that make a lot of use of it generally stave off the influx of specialized chips. These algorithms are thus called "ASIC-resistant." General-use chips that are well-suited to slow RAM, like GPUs and CPUS, can keep trucking along however.Over the last month, Bitmain brought the first such ASICs to market that are capable of overcoming the memory hardness of Monero and Ethereum.In 2014, almost a year before Ethereum launched, Vitalik Buterin visited an “unassuming little building in Shenzhen, China” where he found a small stack of Bitcoin ASICs waiting to be shipped on the third floor. In a blog post, Buterin recounted how on the floor below he found stacks of ASICs that accounted for a quarter of the computing power added to the Litecoin network every day.Buterin marveled at how this one small factory in China was producing this much new computing power everyday on its own. It was hardware centralization in action. The question for Buterin was whether the centralization of ASIC production was actually a bad thing for a cryptocurrency network. After all, the production of GPUs and CPUs is highly centralized as well, with a handful of companies such as Nvidia, AMD, and Intel dominating the market.

THE CASE AGAINST ASICS

Advertisement

Two Bitmain Antminers waiting for repairs. Image: Daniel Oberhaus/Motherboard

“With ASIC miners, right now things are still not too bad,” Buterin wrote in the 2014 blog. “Although ASICs are produced in only a small number of factories, they are still controlled by thousands of people worldwide. Soon, however, that may change. In a month’s time, what if the manufacturers realize that it does not make economic sense for them to sell their ASICs when they can instead simply keep all of their devices in a central warehouse and earn the full revenue?”Today, as in 2014, there are a handful of companies that make cryptocurrency ASICs, although a Chinese company called Bitmain has established itself as a clear leader in the field. Bitmain’s Antminers have become basically synonymous with Bitcoin mining, but the company isn’t just making these chips to sell them—just as Buterin predicted, it also keeps a lot in its own mines. BitFury, an American company, follows a similar business model.When I spoke to Bitmain’s marketing manager Nishant Sharma over email, he said the company doesn’t disclose how many ASICs it is producing as a matter of policy. Furthermore, he said he didn’t how many Monero and Ethereum ASICs the company plans on keeping for itself in its own mines.

At the time of writing, Bitmain’s two mining pools account for approximately 40 percent of the total computing power on the Bitcoin network. Controlling this much of the Bitcoin network means Bitmain also has an outsized influence on the ecosystem. During the Bitcoin forking bonanza last year, Bitmain played a major role in the decision to fork Bitcoin into two versions: Bitcoin core and Bitcoin Cash. There is also the specter of a long-theorized “51 percent attack,” when one miner can hold Bitcoin’s hash power hostage and wreak havoc with the network for as long as they’re in charge.Read More: What Happens When A Chinese Giant Swoops In On Your Tiny Cryptocurrency?

Advertisement

Depending on one company for the majority of the hardware securing the blockchain also poses security risks. For example, in April 2017, anonymous researchers found a firmware vulnerability in Bitmain antminers called Antbleed, which was billed as an ASIC “kill-switch.” This vulnerability allowed Bitmain, a government, or other bad actors to remotely stop Bitmain ASICs from mining on the network, which could cripple Bitcoin. Bitmain denied it was malicious and issued a patch for the vulnerability a few days after it was discovered.The proliferation of ASICs on a network also gradually pushes out miners running GPUs or CPUs, raising the financial barrier to entry. As these less efficient miners’ share of the network computational power shrinks, it eventually reaches a point where the cost of the electricity needed to run these miners is more than they’re earning by mining. These miners can either fork over the cash to buy an ASIC and keep mining, or switch to a different coin. Jimmy Song, a main Bitcoin developer, told me he doesn’t see the centralization of ASIC production as much of a problem.“It’s only a problem in the short term since Bitmain has the majority of miner manufacturing ability,” Song told me in a Twitter message. “Long term there are a lot of players that are looking at the margins Bitmain is making and licking their chops waiting to get in. I know of at least four startups trying to dethrone Bitmain and there’s also bigger players like Intel, Samsung, and Nvidia that have to be looking at this because the margins are so large.”

Jimmy Song, a main Bitcoin developer, told me he doesn’t see the centralization of ASIC production as much of a problem.“It’s only a problem in the short term since Bitmain has the majority of miner manufacturing ability,” Song told me in a Twitter message. “Long term there are a lot of players that are looking at the margins Bitmain is making and licking their chops waiting to get in. I know of at least four startups trying to dethrone Bitmain and there’s also bigger players like Intel, Samsung, and Nvidia that have to be looking at this because the margins are so large.”

Advertisement

Given Bitmain’s domination of the mining industry and less-than-transparent corporate practices, Spagni and many in the Monero community hold the company in bad faith. But even beyond Bitmain and monopoly concerns, the tendency towards centralization in ASICS themselves has the community worried.When I asked Bitmain spokesperson Sharma about fears that ASICs lead to centralization he said that “this hasn’t necessarily played out in practice.”“We are very conscious of this perception and take it seriously given our leadership position,” Sharma told me in an email. “This is why (when smaller crypto networks are involved) we have modulated our sales of mining rigs to ensure that no one customer gets too much of a new batch.”Even if miners don’t want to take Bitmain at its word, however, other researchers argue there are objective security advantages to allowing ASICs on a cryptocurrency network.Joseph Bonneau, an assistant professor of computer science at New York University, presented research at the Financial Cryptography and Data Security conference in February that examined the cost of a hostile takeover of a blockchain. One of the blockchain attacks examined by Bonneau is known as a “rental attack,” which involves renting enough computational power from a cloud service company, for instance, to dominate a blockchain network. As Bonneau notes, this type of attack is only feasible on blockchains mined with commodity hardware like GPUs.

THE CASE FOR ASICS

Advertisement

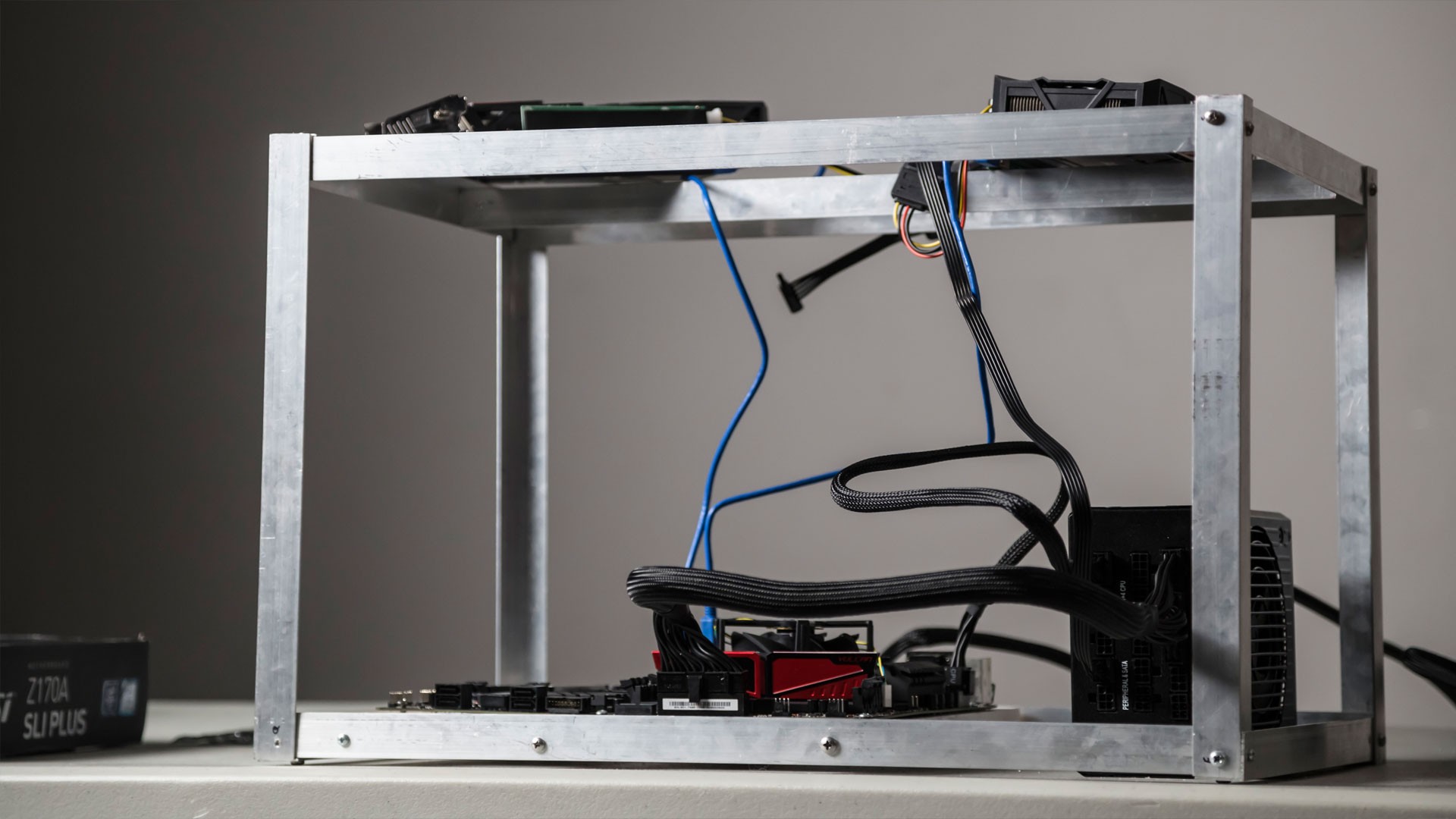

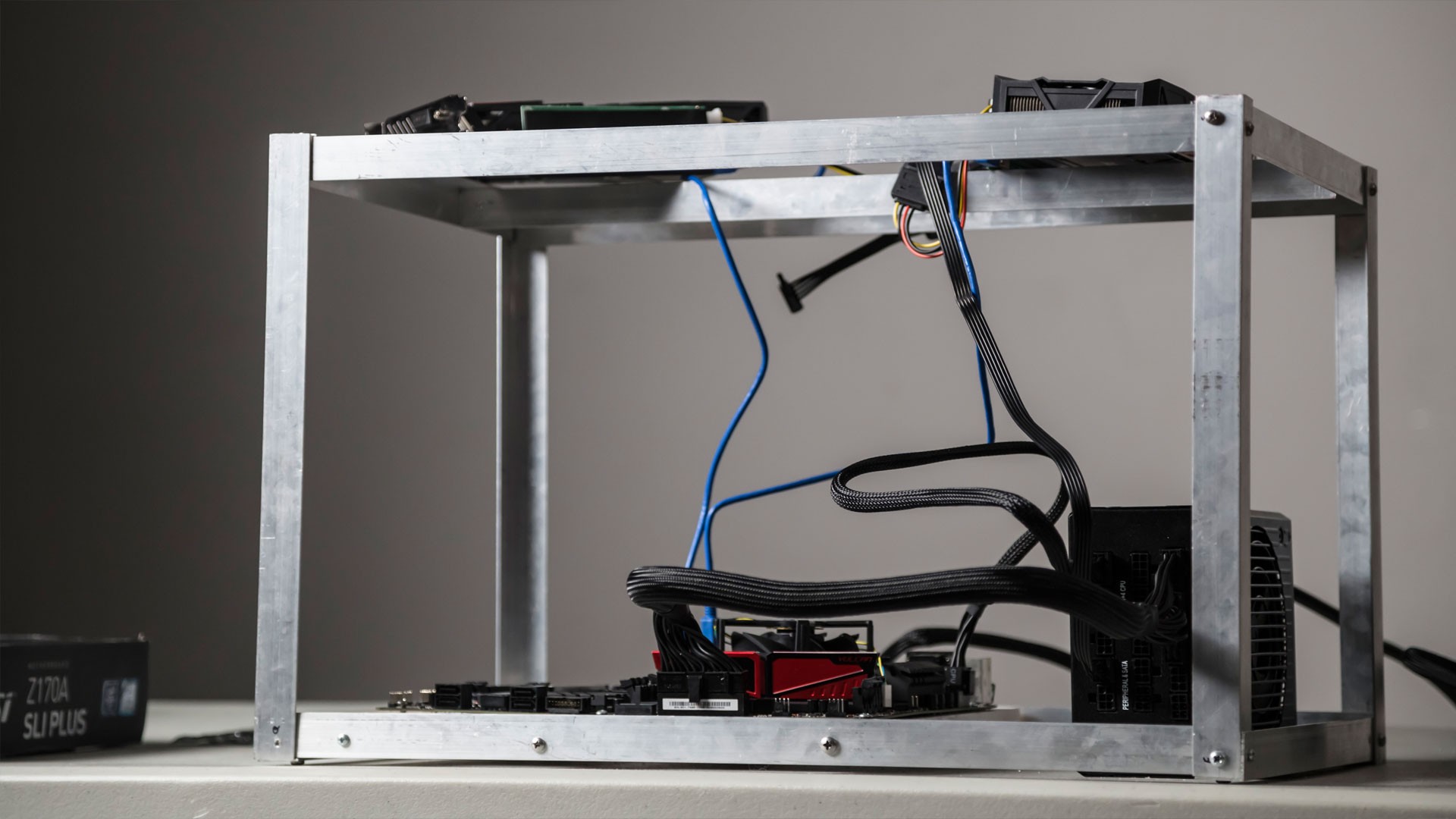

A GPU Ethereum mining rig. Image: Daniel Oberhaus/Motherboard

“For ASIC-dominated proof-of-work blockchains, such as Bitcoin, the rent strategy is likely not possible,” Bonneau wrote. The reason for this, he argued, is that most Bitcoin mining hardware is already accounted for and not up for rent.“Among proof-of-work systems, our analysis indicates a clear security advantage for ASIC-dominated mining, as rental attacks are not possible and existing miners should have more incentive to resist bribery attacks,” Bonneau concluded.As far as Monero is concerned, there may also be a secondary security effect from adding ASICs to the network: Disabling massive Monero mining botnets. In the last few months, “cryptojacking”—wherein a website script surreptitiously uses your unused CPU cycles to mine Monero—has been on the rise. ASIC miners would render this completely unprofitable because they could drive up the network difficulty to levels that even thousands of CPUs working in concert couldn’t compete with.Some even hold the view that centralization is inevitable, with ASICs or without. Software developer Philip Daian argued in a recent blog that centralized economies of scale in the mining space, exemplified by Bitmain, are bound to emerge. A range of factors, including unequal access to cheap electricity, cheap labor, and backdoor deals with regulators will give some large mining businesses a competitive advantage over smaller mining operations, regardless of whether ASICs are involved or not, he argued. In the long term, this may result in the same centralization of resources that anti-ASIC forks are designed to avoid in the first place, Daian wrote.

Advertisement

For example, there’s nothing stopping an ASIC mining giant from cutting a deal with a GPU manufacturer to develop specialized hardware. “Should we oppose those too, insisting on commodity hardware only?” Daia asked rhetorically.Ultimately, Sharma argued that ASICs “demonstrate the mining community’s dedication and commitment to a particular currency—a basis for which participants can have long-term faith in the strength of a network,” Sharma said. “While GPU or CPU mining offers some flexibility in re-targeting toward different currencies, such miners have strong incentive to hop between currencies to their greatest short-term economic advantage.”Implementing ASICs on a cryptocurrency network is a deeply divisive issue, and the consequences are still emerging. After all, Bitcoin just got its first ASICs a few years ago.Spagni and the Monero developers have taken a hardline stance on the issue and are planning a hard fork for Monero that will render Bitmain’s ASICs unusable on the network. When I spoke with Sharma, he said that if this happens Bitmain will still ship the ASICs, which can be used to mine other coins using the CryptoNight algorithm. (There are only a handful of smaller coins using this PoW algorithm, such as Electroneum.)

THE FUTURE OF ASICS

Ethereum is taking a more hands-off approach. During the weekly Ethereum Core developer meeting on April 6, one of the items on the agenda was whether or not to pursue a hard fork that would make Bitmain’s Ethereum ASIC unusable.“Worse case scenario is Bitmain controls a very large portion of the Ethereum network for some short period of time."

Advertisement

For now, Buterin suggested inaction on the basis that the E3 offers only marginal performance increases over top-tier GPUs, so it won’t make a massive difference in terms of computational power on the network. Moreover, Buterin was not even sure what changes would actually render the ASIC ineffective.“At this point I’m leaning toward no action,” Buterin said. “We just have no idea what specific protocol change would actually manage to make a difference.”The Ethereum developers also noted during this meeting that it was probably more worth the time and energy to focus on transitioning the network from proof-of-work to proof-of-stake, which would mean that no mining is done on the network at all. This change has been part of Ethereum’s development roadmap for years, and as it happens it’s also the most effective way to block ASIC mining.The problem, however, is that the timeframe for the transition to proof-of-stake is uncertain, although Ethereum developers see it happening in the near future.“Worse case scenario is Bitmain controls a very large portion of the Ethereum network for some short period of time,” Buterin said. He also noted that if Bitmain or any other company gained control of the majority of the Ethereum network and used it for an attack, the Ethereum developers could rush the rest of the protocol development and deploy a new algorithm in a week just to protect the network as a last ditch measure. On the other hand, Buterin pointed out, companies like Bitmain have an incentive to strategically “downplay” their control over a network, since obvious majority control would encourage developers to switch protocols and render their hardware useless, which isn’t good for business.So until an actual attack happens, Buterin and most of the other Ethereum developers agreed that no protocol change was the best course of action.“People are very emotional about ASICs and are just like, ‘Down with Bitmain, down with ASICs,’ Ethereum developer Hudson Jameson said. “I don’t know where that comes from, I think it may be a crossover from the Bitcoin community. If this is something the community wants and has a good reason, we can do that, but for right now the consensus of the core developers is we shouldn’t do anything at this time.”

He also noted that if Bitmain or any other company gained control of the majority of the Ethereum network and used it for an attack, the Ethereum developers could rush the rest of the protocol development and deploy a new algorithm in a week just to protect the network as a last ditch measure. On the other hand, Buterin pointed out, companies like Bitmain have an incentive to strategically “downplay” their control over a network, since obvious majority control would encourage developers to switch protocols and render their hardware useless, which isn’t good for business.So until an actual attack happens, Buterin and most of the other Ethereum developers agreed that no protocol change was the best course of action.“People are very emotional about ASICs and are just like, ‘Down with Bitmain, down with ASICs,’ Ethereum developer Hudson Jameson said. “I don’t know where that comes from, I think it may be a crossover from the Bitcoin community. If this is something the community wants and has a good reason, we can do that, but for right now the consensus of the core developers is we shouldn’t do anything at this time.”